Project 10C

10C represents:

C as a proto-zero, symbolically representing 100.

C as the number 100; therefore 10C=10*100=1000.

C as standing for “component”, representing a category with 10 distinct components.

My Assessment

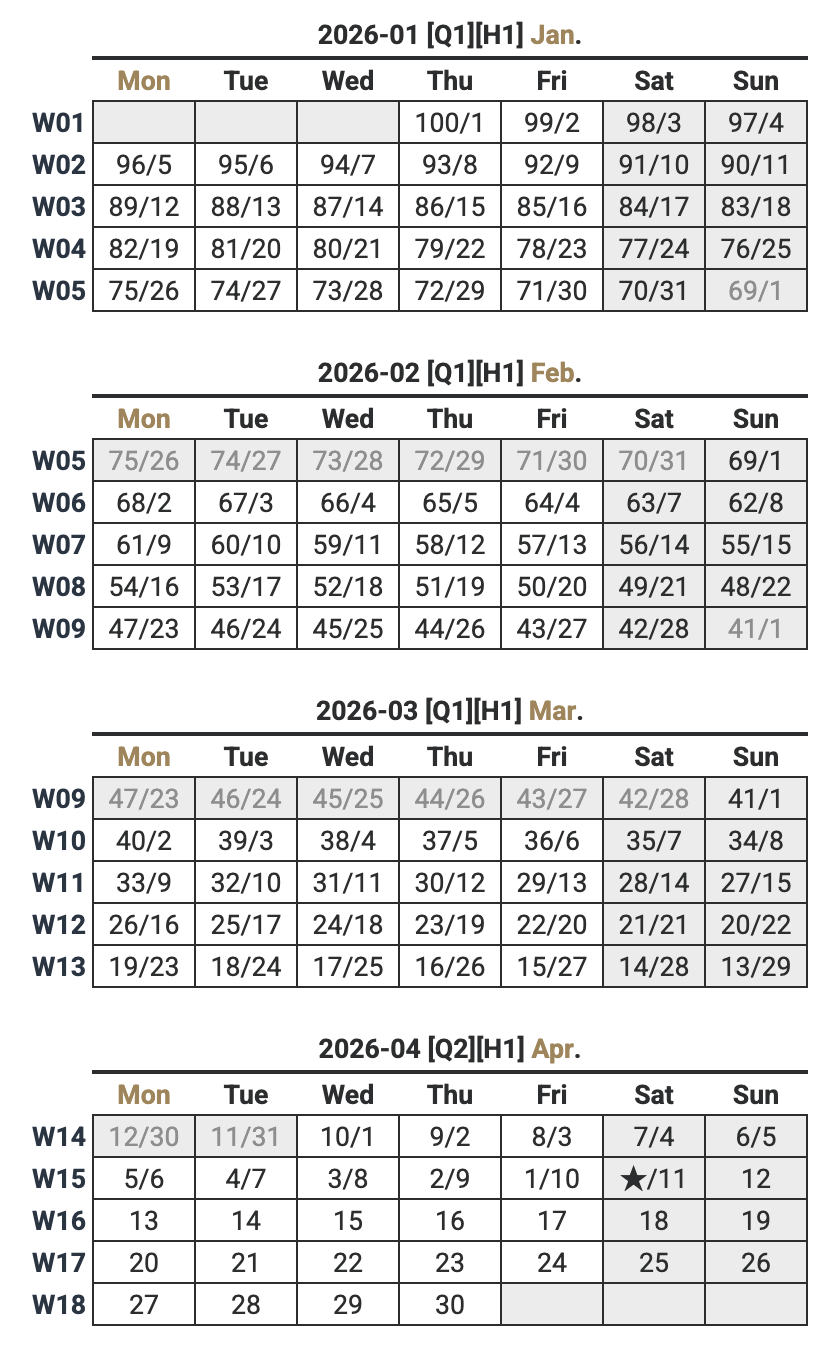

2026 starts with a rapidly closing window of opportunity. The upcoming ~1000 days are decisive, and the first 100 days are disproportionately valuable.

-

Capability curves are advancing faster than adoption curves. But the gap is getting narrower due to strong key players…

Early adopters are not just gaining efficiency, but structural advantage (cost, speed, scale, optionality).

Late adopters face compounded disadvantages as tooling, talent, and standards consolidate early. This is true for people and companies alike.

On the other hand, AI can also be a trap if not used correctly. Cognitive bias and intelligence degradation is a real risk. Even traditional business plans can fail if not correctly adjusted for AI economics.

-

The cost of capital, risk tolerance, and liquidity expectations are being reset globally. Access to capital increasingly favors clarity, leverage, and resilience more than just growth narratives.

Furthermore, AI represents a real risk to current capital markets in different ways:

AI Under-delivers: Several locked in investments can have an abrupt devaluation if AI doesn’t delivers up to the expected value. The ‘bubble’ scenario can create significant structural damage (specially in the US) due to a domino-effect. Potentially triggering a global economic recession.

AI Over-delivers: this scenario will give an unfair advantage to the few key players correctly positioned in the industry. Very few winners with a massive payout at the cost of everyone else. This scenario can end up in social unrest and the need to re-evaluate the economic system (which is a slow & painful process).

-

Those who can act coherently while others hesitate gain disproportionate leverage.

Governments and larger companies usually move slower than reality. They tend to adapt ‘linearly’ while change (specially in this case) occurs ‘exponentially’. This is usually the reason why startups can enter (i.e., disrupt) markets with stale players. The reality that we are facing now has a few additional caveats to consider:

There are MANY new players (startups) actively entering the “game”. Interestingly, the tech is continuously changing faster than most of them can adapt… resulting in a graveyard of ideas and initiatives. Startups now need to run at sprint-like velocity but maintain that cadence for a marathon-like distances. As a result, entering the market is easier than ever, but keeping up with the pace is harder than ever.

There are now strong incentives for big players to adopt the technology ASAP. Speed is not their advantage, but resources and capital is on their favor. Most new startups are just a “feature” away from being obliterated by the big players.

-

The global order is fragmenting into competing blocs with different rules, incentives, and risk profiles.

Supply chains, capital flows, and technology standards are being challenged and redefined. Emerging regions can gain temporary strategic advantage if positioned correctly.

“Understanding the sense of urgency is critical. The first 100 days are more valuable than the last 900 days... Our capacity to build leverage is fading out as an exponentially decreasing function.”

— RHM

Use the next 100 days as a foundational sprint aimed to build leverage. Think strategically and seek for asymmetric moves (i.e., choices that produce outsized results relative to the initial resources). This is not a period for optimization, but for positioning.

My Recommendation

-

Asymmetry favors those who execute fast and learn faster.

Execute in tight loops with signal capture.

Ensure your can get feedback and insights as fast as possible.

Course-correct early and often.

Act Now, relentlessly and in short cycles.

-

Optimization multiplies results ONLY after leverage exists. Therefore, this first 100 days should be focused on building as much strategic leverage as possible.

-

Know your north star. Vision aligns effort; adaptability captures asymmetry.

Keep the long-term intent explicit and stable.

Treat early plans as hypotheses to be tested quickly.

Prefer reversible decisions fast & early; defer irreversibility until leverage is clearer.

Learn to identify between strategic advantages and tactical benefits. Update tactics without emotional attachment.

“The best strategy isn’t about optimizing outcomes, but about maximizing the set of possibilities that resonate with your vision.”

— RHM

Suggested Guiding Values

-

Resiliency

-

Consistency

-

Strategy

Make it count.

Time wont stop for anyone.